When you start a business, identifying the type of business you would like to establish is a major decision. It will have a profound effect on the accounting system for your business and which income tax return form you have to file.

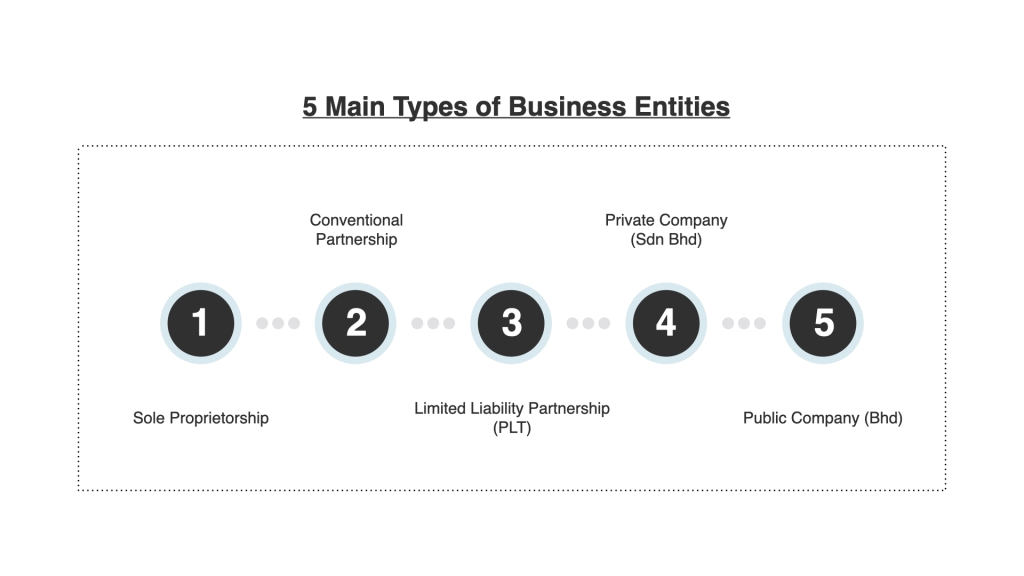

Generally, there are 5 common types of business entities in Malaysia. This includes:

- Sole Proprietorship / Enterprise

- Conventional Partnership

- Limited Liability Partnership

- Private Company

- Public Company

Sole Proprietorship/Enterprise

Sole proprietorship is a form of business that is ideal for single individuals who want to explore new business ventures with limited capital. This form of business is especially common among new entrepreneurs who are venturing in online trading or simply wanting to start their own restaurant, for example.

The government in Malaysia had made it as easy as possible to start up an enterprise in order to encourage entrepreneurship in the local market. Some of the key benefits to set up a sole proprietorship include:

- It is easy to register, and the registration can be done online

- It requires minimal registration fee

- No requirement to disclose financial statements to the public

- It does not involve and require strict compliance to the regulation

However, business owners should be aware that the biggest downfall of a sole proprietorship is that its business liability is unlimited. In another words, the personal assets of the business owner are not protected from the business liability. Furthermore, the existence for sole proprietorship is not separated from the owner himself or herself. As such, the business will cease to exist following the death of the owner. There will be succession issues in an event where the owner passes away or becomes incapacitated.

Conventional Partnership

As self-explanatory as the word ‘partnership’ is, this form of business is ideal for two or more persons seeking to form a business together. It has all the pros and cons of a sole proprietorship, such as:

- Easy to register with minimal fee required

- No requirement to disclose financial statements to the public

- Does not involve and require strict compliance to the regulation.

That being said, the liability of a conventional partnership is also unlimited. This means that your personal assets will not be protected from the business liability, even if you are not an active decision-making partner running the business.

Limited Liability Partnership (LLP)

Limited liability partnership (LLP), or more often recognized as Perkongsian Liabiliti Terhad (PLT) in Malaysia, is a hybrid business model introduced to Malaysians in year 2012. It combines the best features of both a conventional partnership and a private company. It retains all the pros of a conventional partnership, at the same time protecting the partners from unlimited liability, hence making it more like a company instead of a conventional partnership. Small businesses like startups, family-owned businesses, and professional practices are best suited to be registered as a LLP.

Private Company

A private company, commonly known as a Sendirian Berhad or bares the designation of Sdn. Bhd. is a form of business ideal for experienced entrepreneurs wanting to bring the business to the next level.

It protects the owner of the business from unlimited liability, allows tax planning as it is a separate legal entity, and ensures the continuity of the business even after the founder passes away.

The cost of running a private company is relatively high compared to sole proprietorship and partnership, mainly due to the statutory compliance and corporate tax rate. However, this also means that the business is able to obtain loan more easily, as the financial statements are subjected to audit.

Public Company

A public company, or commonly known as a Berhad or bares the designation of Bhd. is a form of business ideal for successful private companies planning for business expansion.

A public company can have unlimited number of shareholders. This means that the company will have the opportunity to finance its business expansion by trading its shares in the open market.

However, making shares available for trading in public also means strict regulation and scrutiny from the authority and the public stakeholders. Financial information is also required to be made available to the general public, so that the general public is well-informed to make an investment decision.

Bottom Line

Although more often a surge of adrenaline is what you need to take the first step, deciding which type of business entity should never be an impulsive decision.

As we have seen, each type of business entity has its own unique characteristic. One should weigh both the pros and cons carefully before choosing the type of business that can bring the most benefits to one’s business.

If you need help in deciding the right business entities for your new venture, Interesources Group is here to help!

Address:

Interesources Group

Room A, 3rd Floor,

309-K Perak Road,

10150 Penang, Malaysia.

Contact Details:

T : +604-2814628

F : +604-2820200

E : interesourcesmarketing@gmail.com